🧭 The Opportunity Curve: A Dynamic Cash Deployment Strategy for Long-Term Investors

A clear, repeatable long-term asset allocation strategy using just SPY, QQQ and cash.

If you've spent years mastering entries, tightening stop placement, or refining your macro thesis, but still feel like portfolio allocation gets less respect than it deserves, this one’s for you.

In this piece, I’ll walk you through a long-term investing framework that pairs high-growth equities with a disciplined, probability-based cash strategy. Think of it as a mental model for deploying capital when the crowd is panicking and raising cash when markets become a little too euphoric.

🔍 The Problem with Static Allocations

Many long-term investors stick to rigid structures: 70% stocks, 30% bonds/cash. That might work for average volatility, but it ignores market context. Drawdowns and euphoric blowoffs are cyclical—yet most investors treat their allocation like it’s carved in granite.

We prefer something more adaptive.

📊 The Core Allocation: 70/30 with Teeth

Baseline:

70% in High Quality, High Growth Companies

30% held in tactical cash

This gives you upside participation with the psychological edge of dry powder when things go sideways.

But the real alpha? How do you deploy that 30%

🧱 Deploying Cash During Market Pullbacks

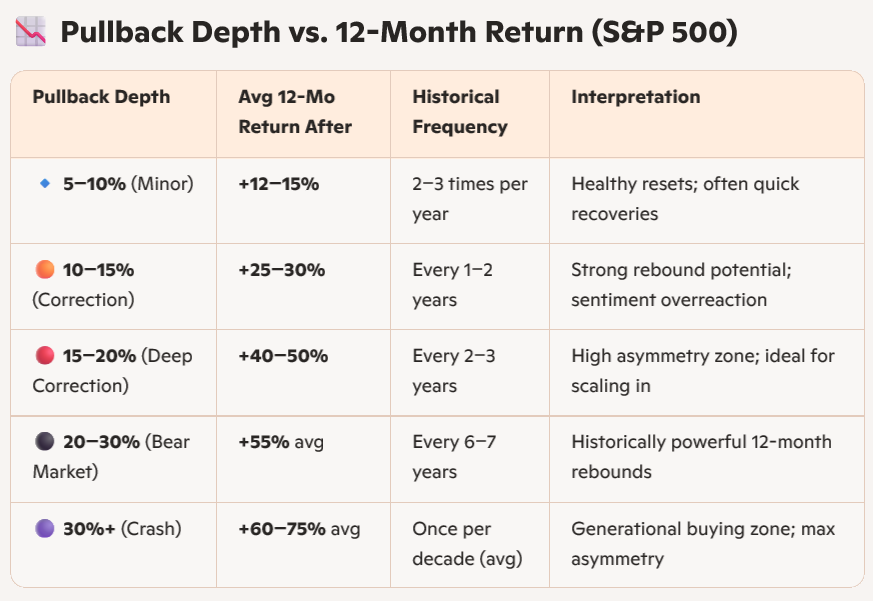

Using S&P 500 and Nasdaq 100 data going back to 1950, here's how often major drawdowns occur—and what markets typically do next.

This isn’t theoretical. After the 2020 COVID crash (~34% drawdown), the S&P rallied +70% in 12 months. These rebounds are asymmetric—if you’re not deploying, you’re missing compounding on sale.

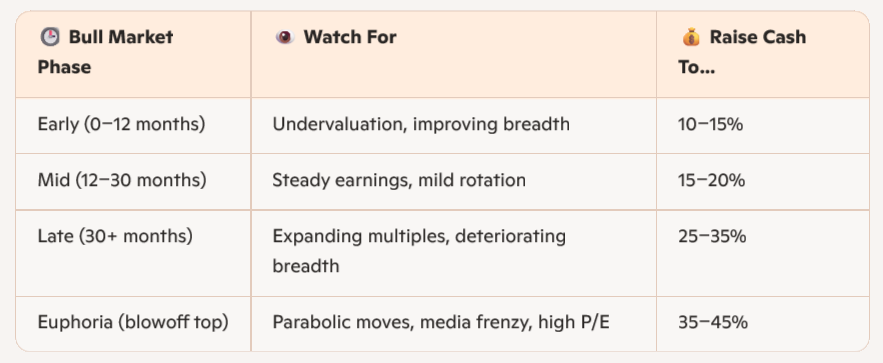

🦺 Raising Cash During Euphoria

Bull markets don’t die of old age—but they do get excessive.

Here’s how we raise cash systematically before momentum fades:

Raising cash isn’t market timing. It’s risk budgeting. You’re simply rotating out of names priced for perfection and making room for inevitable rotation or reset.

🔺 Signs of Excess: When to Dial Up Caution

Markets don’t just fall out of bed—they usually whisper before they scream. These signals can help you spot when price is outrunning fundamentals and risk is rising faster than reward:

🧠 Sentiment & Psychology

Extreme optimism in surveys (AAII bullish > 45%)

Media frenzy around retail speculation or “new economy” narratives

High retail option volumes, especially in weekly calls or zero-day expirations

📊 Price Behavior

Parabolic price action: Vertical moves without base-building

Overbought RSI (70+) or Bollinger Band blowouts on weekly charts

Weak breadth: Fewer stocks making new highs despite index strength

💵 Valuation Stretch

S&P 500 forward P/E > 22–24x

Nasdaq 100 P/E > 30x with decelerating earnings growth

Market cap-to-GDP (Buffett Indicator) at extremes (>130%)

🔌 Macro & Liquidity Conditions

Rising real yields (10yr TIPS > 1.5%) without earnings acceleration

Liquidity drainage (QT, rising reverse repo usage, declining M2)

Fed messaging tightening while markets melt up

🥋 Ronin Mindset: Pull the Blade, Not the Panic

“A master steps back not in fear, but to clear the path for precision.”

When these signs stack up, we raise cash not because we fear collapse, but because structure demands it. This isn’t calling a top—it’s respecting the weight of probabilities and honoring the edge we’ve built.

📉 Pullback Depths & Durations (S&P 500 / Nasdaq 100)

📈 Average Duration and Extent of Bull Markets

🥷 Final Takeaway

“A single precise strike can end a duel. The disciplined warrior does not seek many chances—only the one that tilts the battlefield.”

In the language of the blade, asymmetric opportunities are those rare setups where the risk is limited, but the reward is outsized, not through luck, but through structure, patience, and positioning. Just like a katana finds its mark in stillness, your edge reveals itself when others are distracted by chaos.

You don’t need more trades. You need the right ones.

You are that samurai. Your cash is the blade. Structure is your edge. This is how we think about capital as a weapon, not just a tool.

Daily Option Edge

Structure is a superpower.

- Jeff Brewer (Volatility Samurai )